Best ELSS Funds to Invest in India for 2023

Are you looking for the best ELSS funds to invest in India for 2023? ELSS, or Equity Linked Savings Schemes, are a great way to save on taxes and to invest in the stock market.

Investing in ELSS funds can give you the opportunity to earn a good return on your money, as well as helping you save tax. If you're looking for the best ELSS funds to invest in India for 2023, then you've come to the right place. Here, we'll provide you with information on the top ELSS funds to consider investing in this year.

Read More : Top Mutual Funds for Salaried Persons 2023

Best ELSS Funds to Invest in India

ICICI Prudential Value Discovery Fund -

If you're looking for a best ELSS funds to invest in, the ICICI Prudential Value Discovery Fund is definitely worth considering.

This ELSS fund has been consistently ranked as one of the top performers in its category since its launch in 2004.

It has a diversified portfolio with exposure to large-cap, mid-cap, and small-cap stocks, ensuring steady returns over the long term. The fund is also tax-efficient and has a lower expense ratio than many other ELSS funds.

It’s an ideal option for investors seeking reliable long-term growth and consistent returns.

Read More : Top Mutual Funds for Salaried Persons 2023

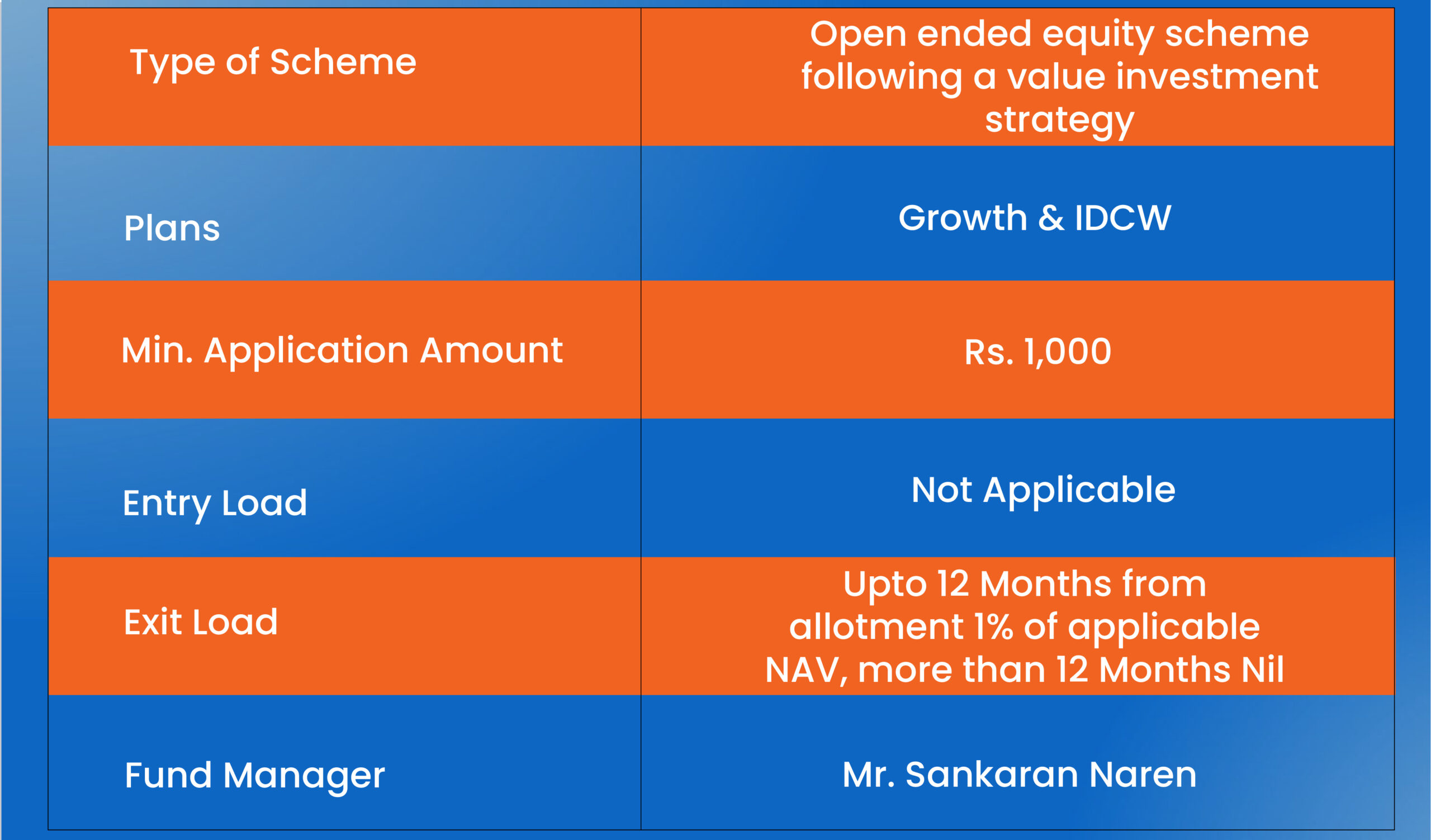

Scheme highlights -

HDFC Tax Saver Fund -

The fund's objective is to generate long-term capital appreciation from a portfolio consisting of equity and equity-related instruments.

The fund generally invests at least 80% of its total assets in equities and equity-related instruments of domestic companies. The fund has an experienced team of fund managers who are adept at the stock selection and portfolio construction, thereby ensuring the best returns for investors.

DSP BlackRock Tax Saver Fund

The fund's primary objective is to generate capital growth over the long term. It invests in equity and equity-related securities and uses a mix of value investing and growth investing strategies to generate returns.

The fund mainly invests in large-cap stocks, mid-cap stocks, and small-cap stocks. The portfolio is well diversified across sectors

The fund also follows a buy-and-hold strategy, which minimises market volatility risk.

Overall, DSP BlackRock Tax Saver Fund is an excellent ELSS fund for those looking for long-term capital appreciation.

The fund has delivered strong returns in the past, and it is well-diversified across sectors. Moreover, investors can claim a deduction of up to INR 1.5 lakh under Section 80C of the Income Tax Act when they invest in this fund.

Franklin India Taxshield -

This ELSS fund is suitable for investors looking for a moderate to high level of risk, with a long-term perspective.

The portfolio is well diversified, with the top ten holdings constituting 40% of the total portfolio.

This ensures that the portfolio is not overly exposed to any single stock. Franklin India Taxshield has an expense ratio of 0.93%, which is lower than the category average of 1.41%.

Thus, investors can rest assured that their investments are not getting eroded due to unnecessary fees.

So the best things is when you invest in ELSS funds you get dual benefit first tax deductions and secondly wealth creation .

Following are the best ELSS funds schemes which can helps you accumulation the wealth . all the recommended by top brokerage houses and reviewed by our team .

Read More : Top Mutual Funds for Salaried Persons 2023