THE UNTOLD SECRET OF REMARKABLE RETURNS WITHAIFS / PMS

AIFS / PMS

A platform for curated investment opportunities beyond bonds, mutual funds, Fixed Deposits, and Gold. All of your financial issues will be handled by us, and they will be handled one at a time so they can be kept under control.

We will Show you how to Seize the "Cash Creation Opportunity" of a Lifetime with the New Selected AIF's More Millionaires ( Crorepati's) have been made in the last few years than at any other time in history. And most of them have done it by investing in the stock market. But they didn't do it by sitting on the sidelines They did it by learning a system and using strategies that truely worked. They did it by having the courage to "TAKE ACTION"

They did it by getting access to exclusive knowledge of High Performing Funds that few others even know exists. Next 18 months can be the best years for Wealth Creation as the Indian Economy moves closer to a boom in which you will see some star stocks in small cap which have the potential to become mid caps or even large caps... Some if these stocks have already been identified by top Fund Managers who offer them to Sophisticated Investors for Wealth Creation. With Options24 research now you too have an opportunity to discover the best of the best well researched AIF where the Funds is putting their own money to reap profits..!! Here is not so Good News. Unless you take specific well timed action Now and look at limited AIF schemes you may miss this huge Wealth Creation Opportunity Of a Lifetime...

The Biggest Risk a Missed Opportunity.

OUR PARTNERS

Know more

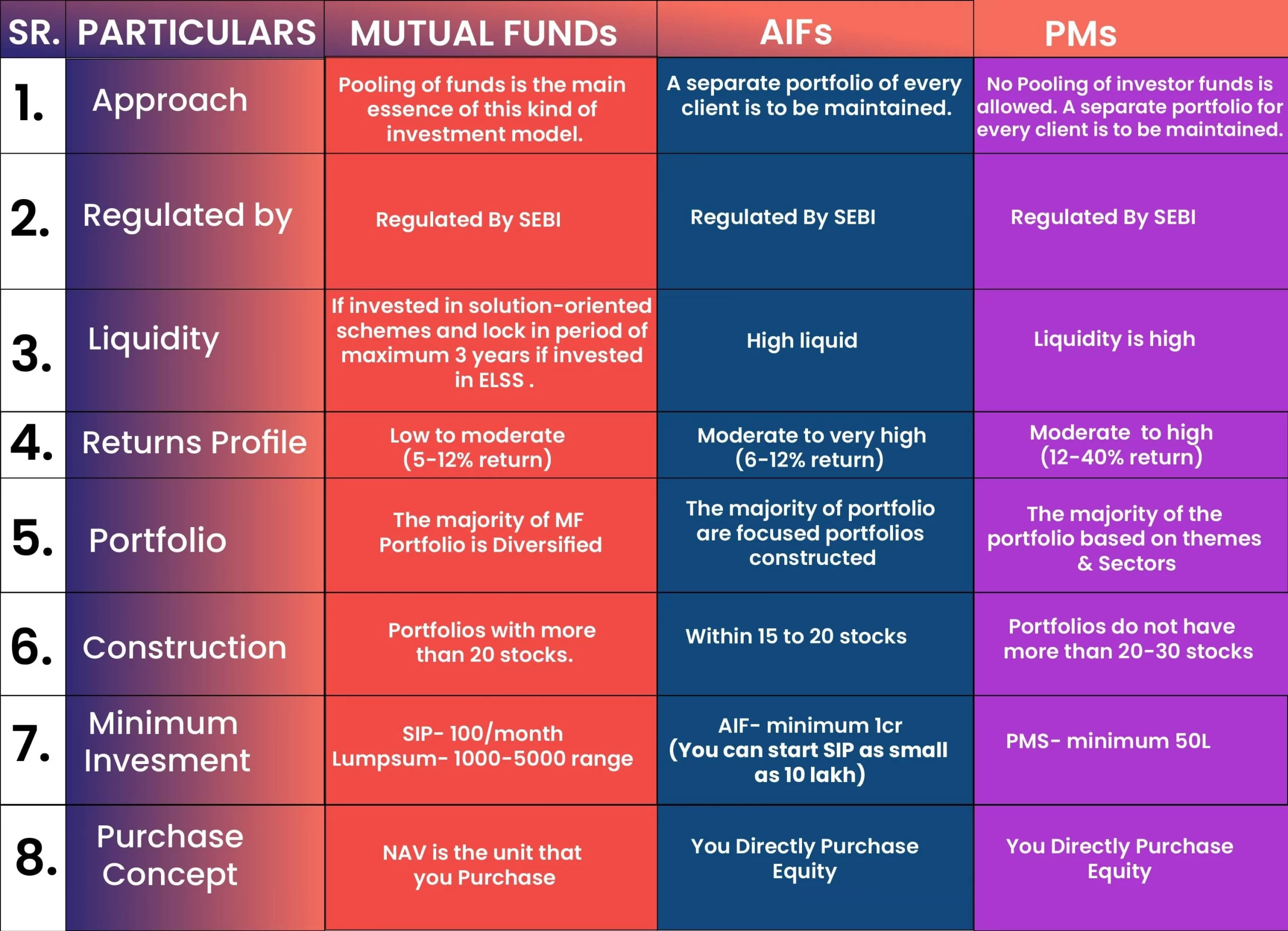

BIG QUESTION WHY AIFs IS BETTER THAN MUTUAL FUNDs?

AIFs are the most adaptable of the three investment vehicles since they permit shorting, leverage, and investing in unlisted shares. This makes it possible for AIFs to offer strategies that are significantly more complicated than what is available under PMS or Mutual Fund Structures. As a result, investors have access to the widest variety of risk-reward possibilities possible.

And what's cool is,

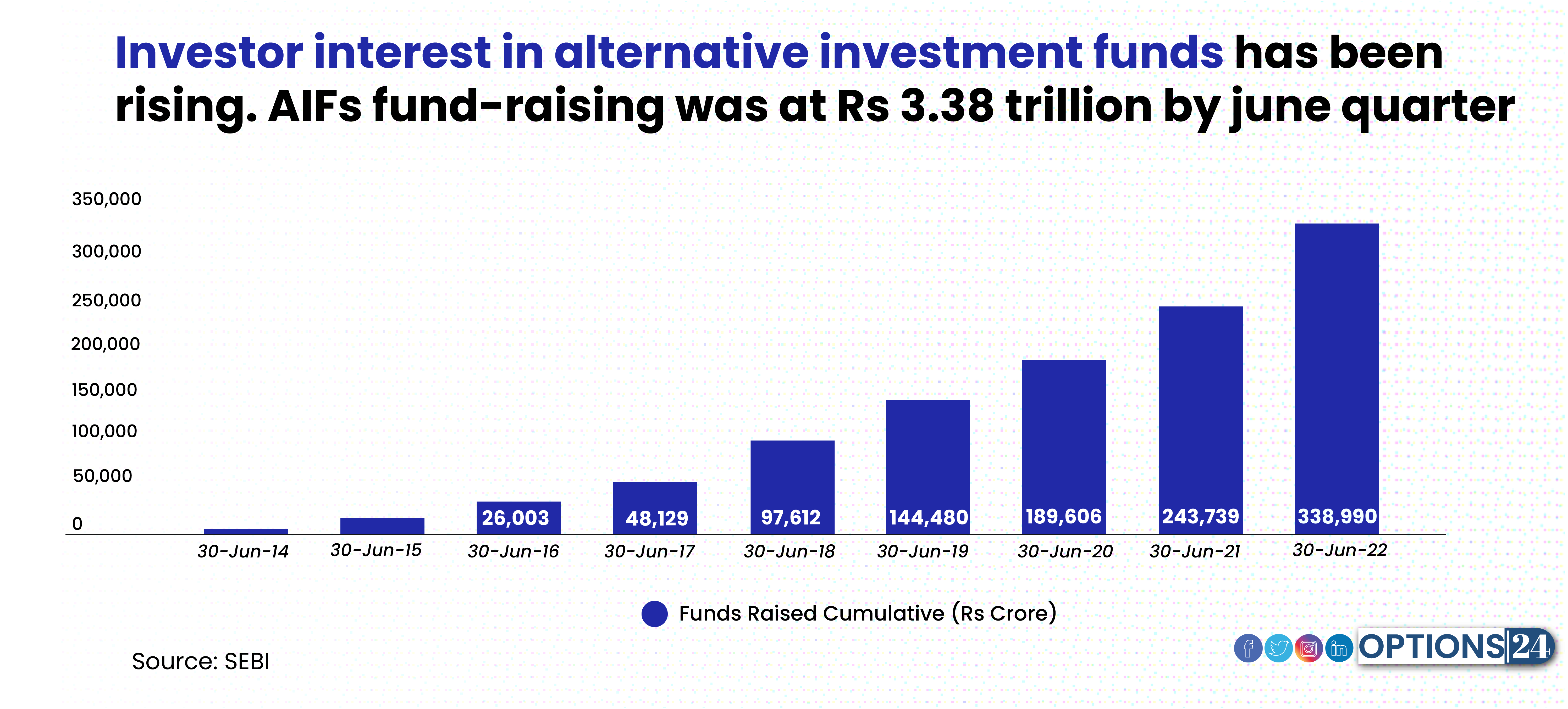

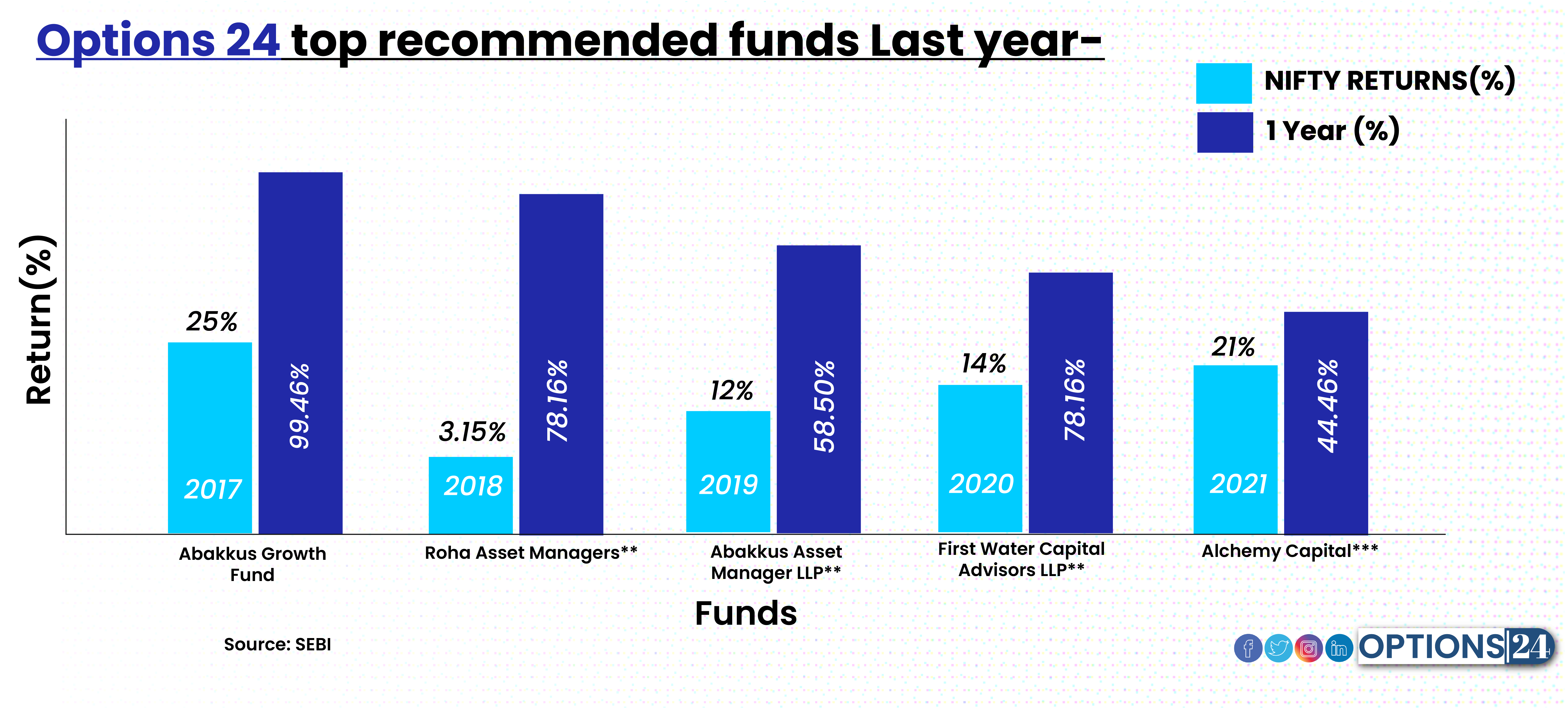

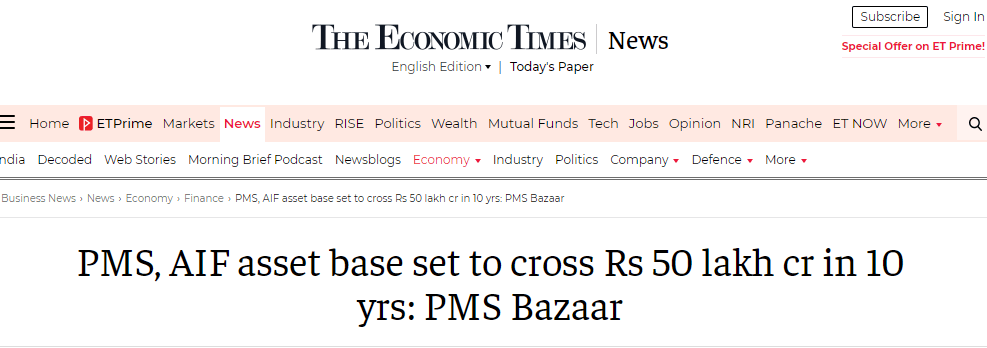

If you observe in the last slide by your own research you will know that AIF has given atleast 15 to 40% CAGR return and they are highly profitable for investors for who have a risk taking appetite.

Options 24 has already done the heavy lifting of finding the top open AIFs schemes which are specific to your needs.

Our team is made up of highly trained CFA, AUM, and hedge fund managers.

As a result, you can skip the research. Let's look at an example to assist.

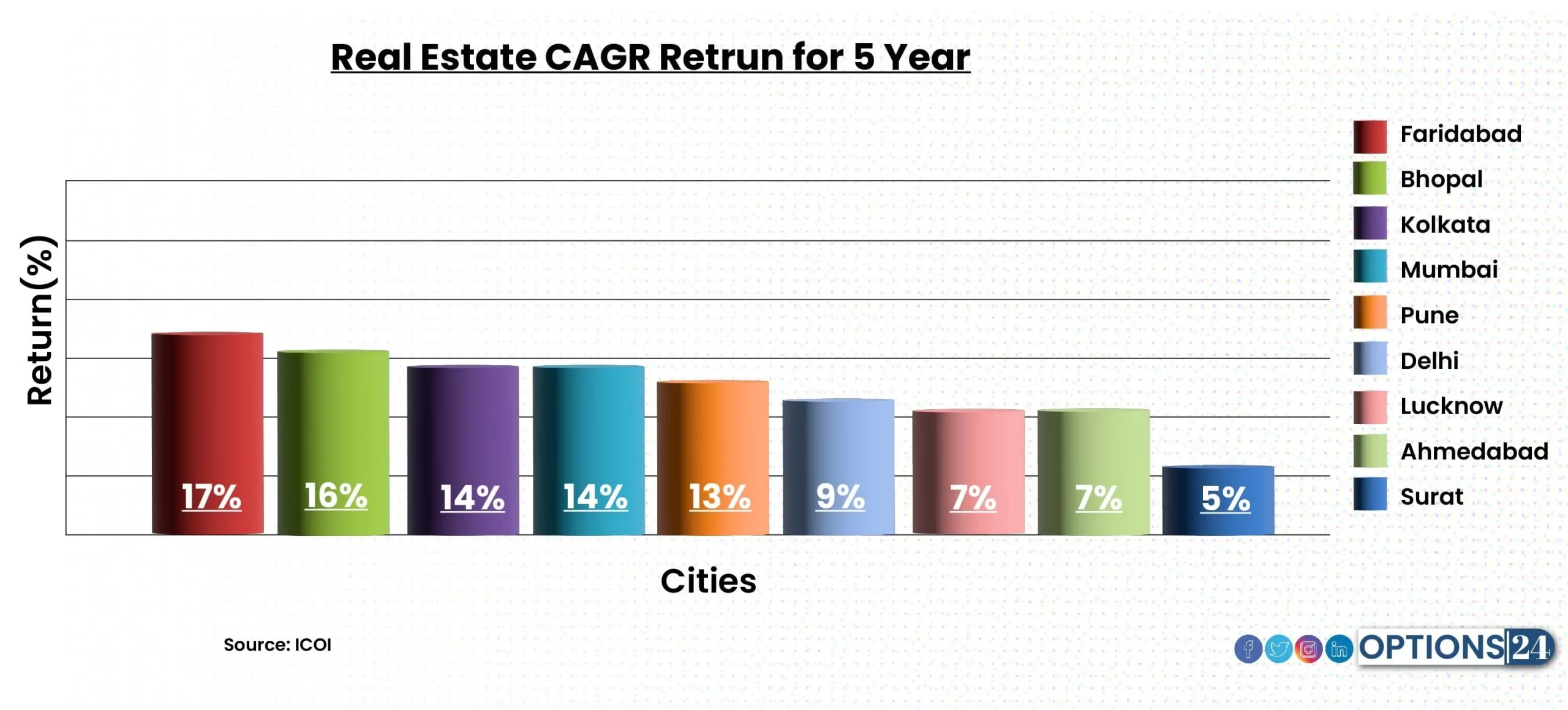

You put your hard-earned money on real estate in prominent Indian cities.

Let's examine the data.

Here are top AIFs / PMS headlines that leading finance sites have covered....

There are just four different sorts of investments to compound your money.

The biggest problem that is associated with selling your real estate investment. A high liquidity risk implies that it is difficult to sell an investment when needed.

Rather than the AIFs case, you can easily sell your investment after the lock-in period . At the time of any real estate transaction there are several taxes on the sale of the property.

The taxes levied on the sale of property are

- Capital Gains Tax

- TDS @ 1%

- Service Tax on Property

- VAT is applicable on Commercial Property

- Stamp Duty on Property (Determine by the Government)

What do you think does it make sense,

Now, you see we give so many taxes in real estate investment that our investments are reduced due to the taxes mentioned above.

If we compare, in AIFs schemes we just give one tax when our investment gets matured.

Now you know, which deal is better? So choose wisely.

Why NRIs and HNIs switched to AIFs / PMS

However, with AIFs, neither opening fees nor a Demat account is required. The second benefit is taxation at the scheme level.

The third factor is a pooled vehicle, so all investors at the same closing have comparable return experiences.

Additionally, If you are an NRI investor No requirement/restriction on opening a PIS(Portfolio investment scheme) account.

A New Age Investment Services Company, options 24 offers high-quality investing services with the goal of promoting success and wealth. We have been managing 50 Cr+ assets for 24+ HNI & NRI households for more than 3 years. We provide the appropriate services, goods, and portfolios to support your well-informed investing choices. Mission - We believe that India deserves investment products that enable true economic value with less speculation. At options 24, our endeavor is to create a new, technology-first financial institution that lives by the values of transparency & efficiency, delivering financial products that bring you wealth and prosperity. Looking for an investment option for your AIFs / PMS fund? Look no further than Options 24. We offer a wide range of investment opportunities, as well as advice on how to best invest your money.

We are committed to providing all investors with the finest environment for developing and putting into practise research-based wealth-improving solutions. Additionally, we'll grant you access to our Whitepaper, "The 9 Golden Rules For Effective Value Investing," which holds the key to successful investing. This offer is only available to those who plan an investment session. You only need to take one step to take charge of your future. All you have to do to get started is click the button below.

Powered by Social Blow Up